In Nevada’s wholesale cannabis market, the question of whether wholesalers prefer indoor or outdoor flower is not merely a matter of style. Instead, it is shaped by regulations, geography, and the high expectations of retailers and consumers. While both cultivation methods have roles in the wider U.S. market, Nevada wholesalers largely lean toward indoor and greenhouse-grown cannabis.

Regulatory Restrictions Shape Supply

The first factor is policy. State law allows outdoor cultivation under certain conditions, but individual counties often enforce stricter limits. In Clark County, home to Las Vegas—the beating heart of Nevada’s cannabis economy—outdoor commercial cultivation is prohibited. This leaves indoor and greenhouse facilities as the primary supply source for the region. With Las Vegas dispensaries accounting for a significant portion of sales, wholesalers gravitate to the grow methods that can actually serve the market consistently.

Harsh Desert Climate

Beyond the legal framework, the environment itself is unforgiving. The Mojave Desert presents cultivators with alkaline dust storms, intense heat, and mineral-heavy water, all of which make producing premium outdoor cannabis extremely difficult. Outdoor farms also face seasonal limits, typically achieving only one harvest per year. For wholesalers who must provide steady supply throughout all twelve months, depending on a single outdoor harvest is simply not feasible. Indoor and mixed-light facilities provide consistency that aligns with the demands of Nevada’s year-round tourism-driven retail scene.

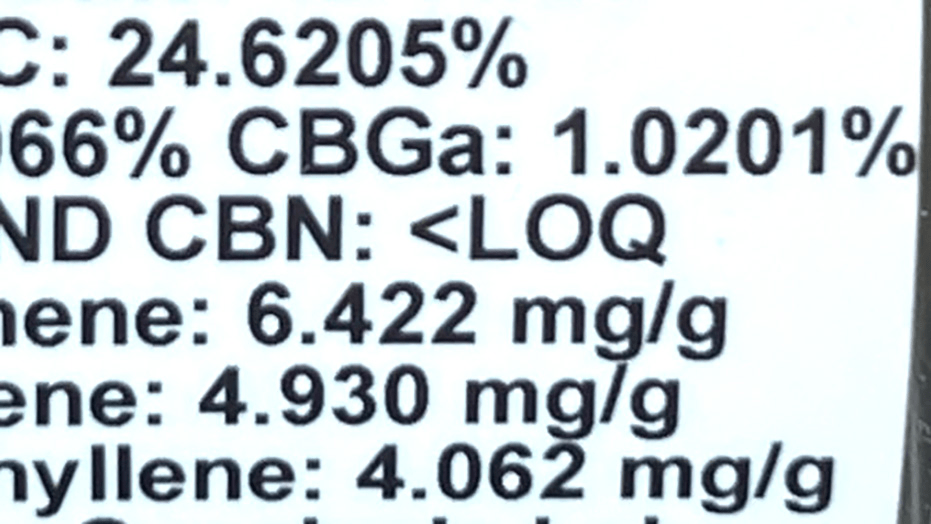

Consumer Expectations

Indoor cannabis also delivers the traits that buyers and retailers prioritize. Tourists and local consumers expect high potency, bright aesthetics, and aromatic terpene profiles. Controlled environments enable cultivators to fine-tune lighting, temperature, and humidity, ensuring consistency across batches. Wholesalers recognize that this reliability supports stronger pricing and keeps dispensaries stocked with flower that consistently meets consumer standards.

Price Behavior and Market Data

Wholesale data reflects these preferences. Indoor flower in Nevada has historically commanded higher prices than greenhouse or outdoor counterparts, a pattern that reflects its premium reputation. Even during periods of market oversupply, indoor and greenhouse products maintain more stability in pricing. Outdoor cannabis, when it appears in the Nevada market, is often relegated to biomass and extraction rather than premium flower sales.

Seasonal Considerations

National market dynamics further reinforce the trend. Each fall, outdoor harvests from states like California and Oregon create temporary price drops for bulk biomass. While Nevada’s restrictions limit local outdoor production, wholesalers remain alert to these seasonal supply waves, which can impact negotiation for trim and extraction inputs. Still, for dispensary-ready flower, indoor remains the clear favorite.

The Cost of Indoor

Indoor cannabis is not without challenges. Energy costs in Nevada are among the highest burdens cultivators face, driven by lighting and HVAC requirements. Utility rate classifications can further inflate expenses, cutting into cultivator margins. Yet wholesalers are willing to accept these higher costs, recognizing that dependable, top-quality flower supports consumer trust and brand reputation in a competitive market.

The Wholesale Bottom Line

Nevada wholesalers operate in a tough landscape, defined by price compression and pressure from both illicit sales and hemp-derived THC products. Success depends on consistency, repeatability, and strong brand recognition. Indoor and greenhouse cultivation offer the reliability wholesalers need to meet those expectations. While outdoor cannabis may serve niche purposes, the future of wholesale in Nevada remains firmly centered on indoor production.